In 2022, global fines for failing to prevent money laundering (AML) and other financial crime surged more than 50 percent, totaling more than $2 billion in the banking sector alone. With the ever-increasing complexity of AML regulations and the global nature of financial services, financial institutions are investing more resources into compliance and due diligence to protect their businesses.

Join us for an engaging conversation about the complexity of Know Your Business (KYB) and Know Your Customer (KYC) regulations and discover how a single, integrated identity platform can help streamline the process of truly knowing the entity and the people you are doing business with.

In this webinar, you will learn:

- The latest trends in KYB and KYC and how to protect your business

- How artificial intelligence can help streamline tedious, manual verification processes

- New strategies for verifying people and businesses with an integrated identity platform

In collaboration with

Can’t join us live? Register now, and we’ll send you the recording.

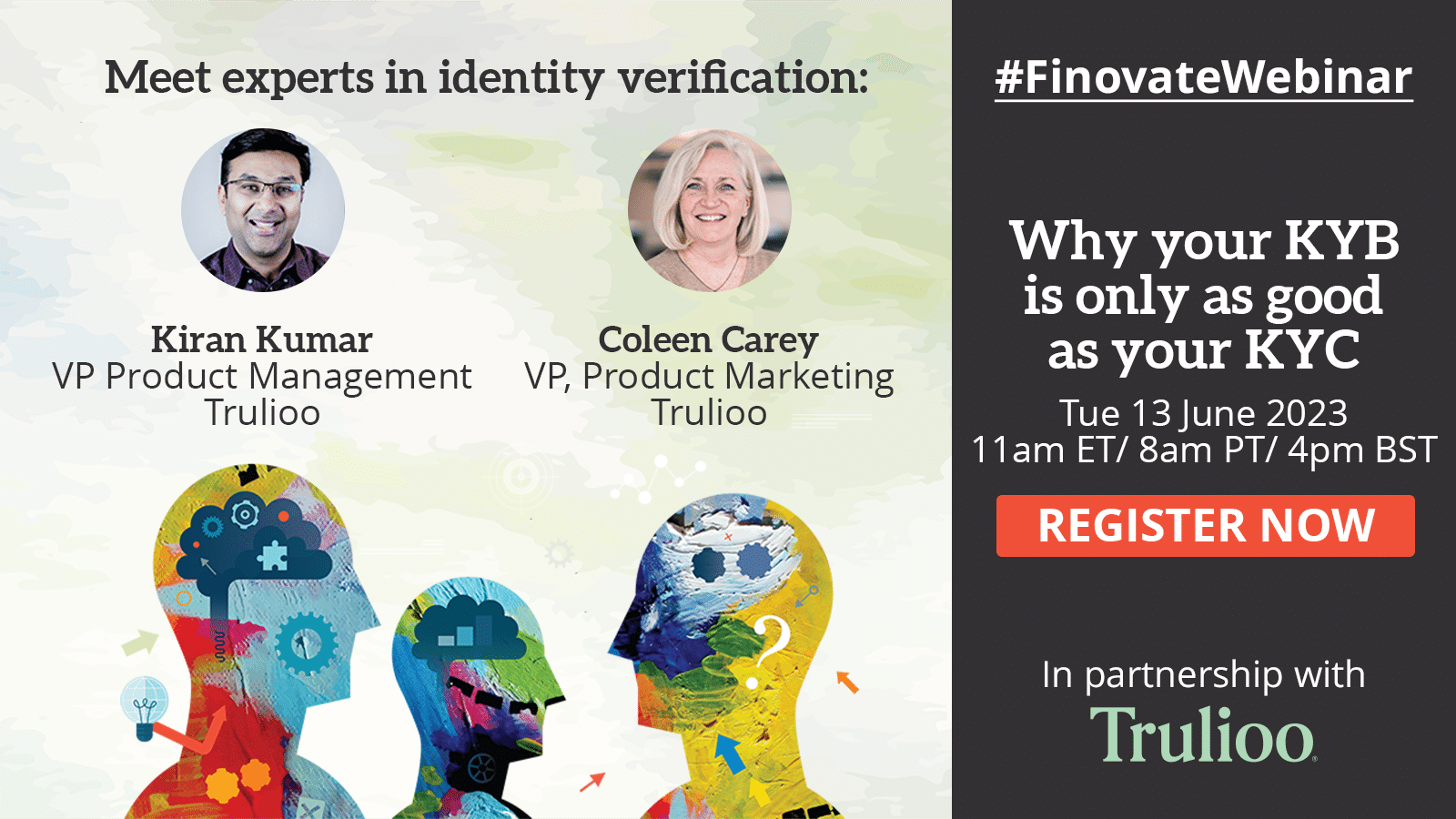

Speakers:

- Kiran Kumar, VP Product Management, Trulioo

- Coleen Carey, VP, Product Marketing, Trulioo