- American Express is launching American Express Business Blueprint, a set of digital cash flow management tools for small businesses.

- Small businesses can access the MyInsights cash flow solution within Business Blueprint at no charge.

- Business Blueprint evolved out of Kabbage, an alternative lending startup that the company acquired in 2020. With the launch of Business Blueprint, the Kabbage brand is now retired.

Cash flow management tools are not new to fintech, but the industry gets excited when card giant American Express launches new tools. That’s the case today– the company unveiled American Express Business Blueprint, a set of digital cash flow management tools for small businesses.

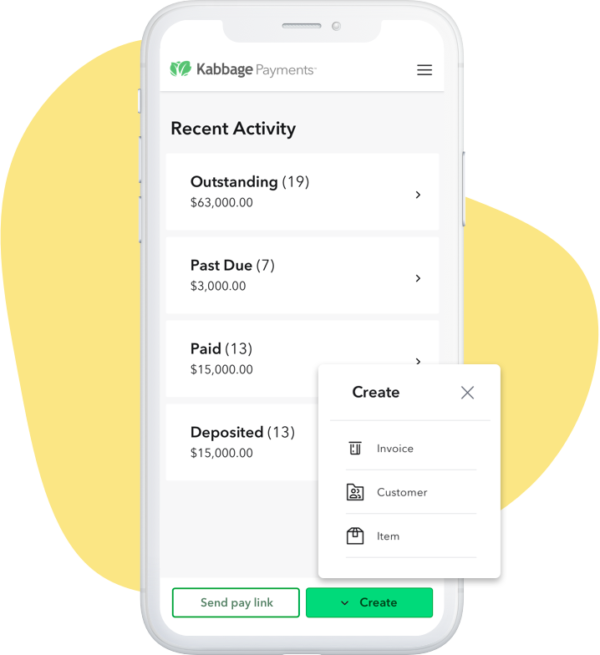

Business Blueprint offers small business users digital financial products, payment card management tools, and cash flow insights via its MyInsights tool. The platform offers to lighten the load of small business owners by helping them manage cash flow, take out a loan, pay bills and vendors, check their account balances, deposit checks, accept card payments, and more. Additionally, the tool projects cash balances out to 30 days and sends spending alerts, as well as enables users to view and redeem their membership rewards points.

“Business Blueprint marks a critical next step in American Express’s vision of becoming a digital one-stop shop for small businesses’ financial needs, whether to manage their cash flow, make payments, get paid, or access working capital,” said company Group President of Global Commercial Services and Credit & Fraud Risk Anna Marrs.

American Express is onboarding small businesses onto Business Blueprint for free, and offering its MyInsights cash flow solution to them at no charge. That’s because the company is looking to sell businesses on its small business lending products, including:

- American Express Business Line of Credit for a commercial line of credit ranging from $2,000 to $250,000 with interest rates ranging from 2% to 27%, depending on the term

- American Express Business Checking for a digital business checking account that earns 1.30% APY on balances up to $500,000, and the ability to earn Membership Rewards points

- American Express Payment Accept for accepting all major card payments from customers online

The new offering is rising out of the ashes of Kabbage, an alternative lending company launched in 2009 that American Express acquired in 2020. As Kabbage Co-Founder Rob Frohwein explained in a post on LinkedIn, “The end of era – for me and my Kabbage from American Express colleagues. Our company is fully integrated with Amex (and I’ve been gone for over a year).”

Frohwein went on to reminisce about how the day his team named the company “Kabbage.” One of the company’s early investors, Nicholas Steele, wanted to go with the name Cabbage. However, the “C” was changed to a “K” when the team discovered the cost of the Kabbage domain name was $73,800 cheaper. “Congrats to all Kabbagers – old and current. You may now refer to our business as Business Blueprint, but you’ll always bleed green and think twice when you enjoy actual cabbage in your salad or soup,” Frohwein added.