Last week, we looked at Finovate alums that are leveraging their technologies to help employers help their employees achieve financial wellness and greater financial inclusion. Today we are highlighting a Finovate alum – and Best of Show winner – that is using its innovation to facilitate charitable giving in the workplace.

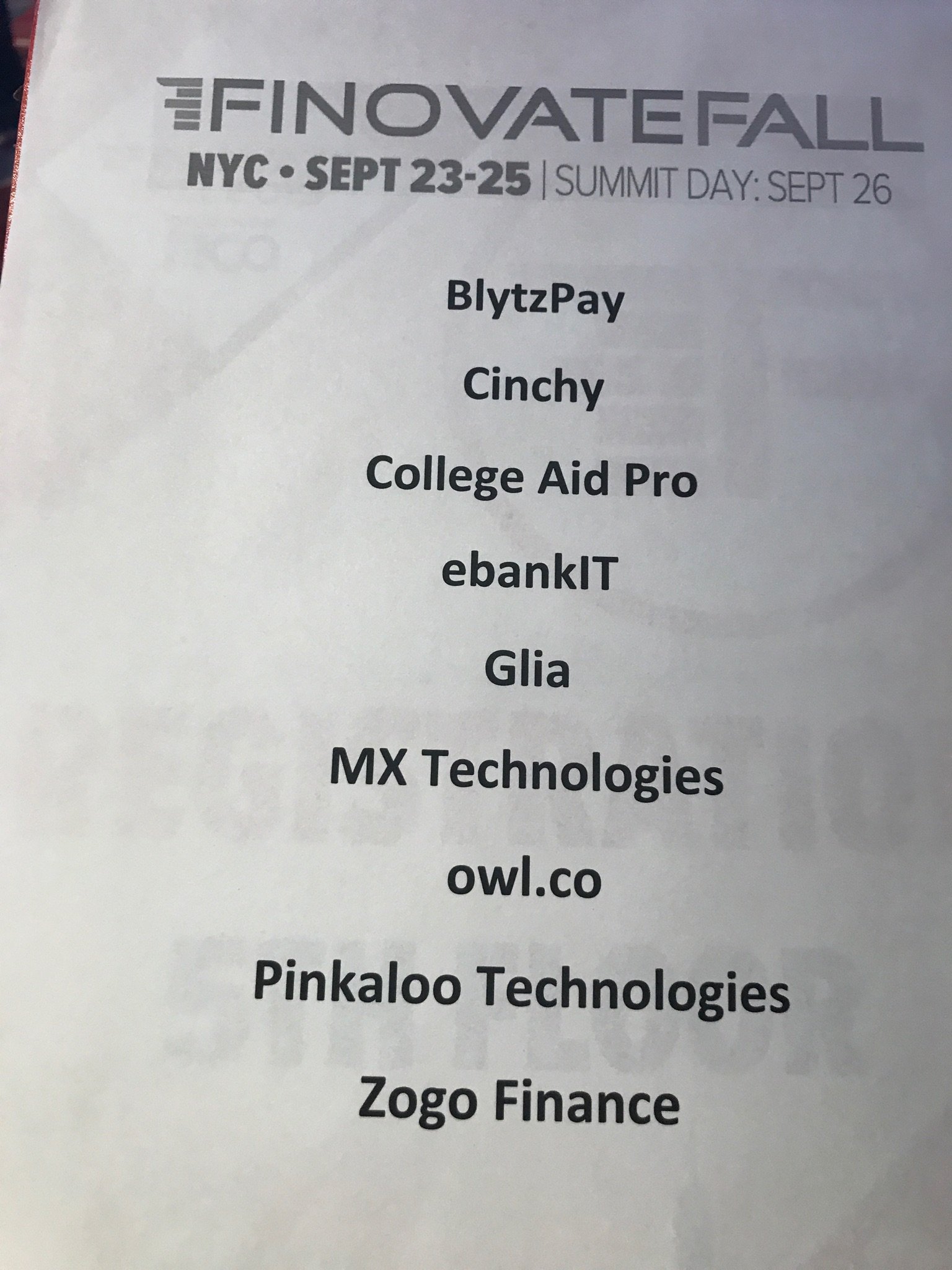

Founded in 2017 and headquartered in Baltimore, Maryland, Pinkaloo made its Finovate debut two years ago at FinovateFall. At the conference, the company demonstrated Modern Giving, its white-label charitable giving platform. The technology gives individuals a centralized account to use for their charitable giving, learn about other charities that match their values, and collaborate on philanthropic efforts with others. Modern Giving enables businesses to maximize engagement with their employees and customers, helping promote and drive charitable giving in their communities.

“Pinkaloo’s white-label Modern Giving offers an opportunity to attract new banking customers and members, as well as more deeply connect with your current customers around an area that they are deeply, deeply passionate about and truly care about strongly,” Pinkaloo founder and CEO Gideon Taub told our FinovateFall audience. “At the same time, your banking institution can make more money and hit your KPIs while directly powering the charitable giving of your customers and members.”

The company’s demonstration was impressive enough to earn Pinkaloo a Best of Show award in its first Finovate appearance. And it looks as if our Finovate audience was not the only one paying attention to Pinkaloo’s achievements. Less than two years after its award-winning appearance on the Finovate stage, the company announced that it had agreed to be acquired by Ren (formerly RenPSG), a leading independent philanthropic solutions provider. Terms of the transaction were not disclosed.

Founded in 1987 and headquartered in Indianapolis, Indiana, Ren supports more than $20 billion in assets. The firm partners with financial services companies, nonprofits, and community organizations to offer online access for donors, advisors, and employees to manage a variety of planned gifts ranging from charitable trusts to endowments and private foundations.

“Today’s philanthropic ecosystem demands ongoing innovation in how we recruit, engage, and retain donors – all while also giving donors the best possible experience,” Taub said when the deal was announced. “Donors want to be involved and drive change via small and large contributions alike. They need a robust platform to do just that – and a RenPSG-Pinkaloo team uniquely answers that demand.”

The future of the Pinkaloo brand, post-acquisition, remains to be seen. Techincal.ly quoted Taub in March 2021 as indicating that a “new shared brand will emerge from our combined company” as the two entities “integrate and innovate.” With employees around the country, Pinkaloo said it will retain its “Baltimore presence” as its leadership and team are integrated into Ren. Taub praised Ren for “respecting and welcoming our ideas and processes,” adding that the alignment of visions between the two companies “makes for an easy transition.”

Pinkaloo was a finalist in the Reimagine Charitable Giving Challenge sponsored by the Better Giving Studio (BGS) of Giving By All, an initiative of the Philanthropic Partnerships team of the Bill & Melinda Gates Foundation. Previous to its acquisition by Ren, Pinkaloo had raised $1.8 million in funding from investors including Squadra Ventures, C5 Accelerate, TEDCO, Baltimore Angels, and PeaceTech Accelerator.